DONATE TO PATHPOINT! A donation makes a huge difference by allowing children, adults, and families to find hope and empowerment, build life skills, access systems of support, and develop meaningful relationships. Please visit: https://www.pathpoint.org/donation/

Planned Giving

Leave a Legacy

Would you like to leave a meaningful legacy in your community? You can leave an impact on the future of your community by making a planned gift to PathPoint. These gifts include:

- simple bequests in wills and trusts

- designations in IRAs and insurance policies including Legacy Life Insurance

- charitable remainder trusts

Learn more about these various giving options below and review recommended bequest language that you can share with your attorney. When you make a commitment to a future legacy gift, you will be recognized as a member of the PathPoint Legacy Society, which acknowledges our most visionary supporters. More details can be found in the PathPoint Legacy Society brochure.

PathPoint Legacy Society

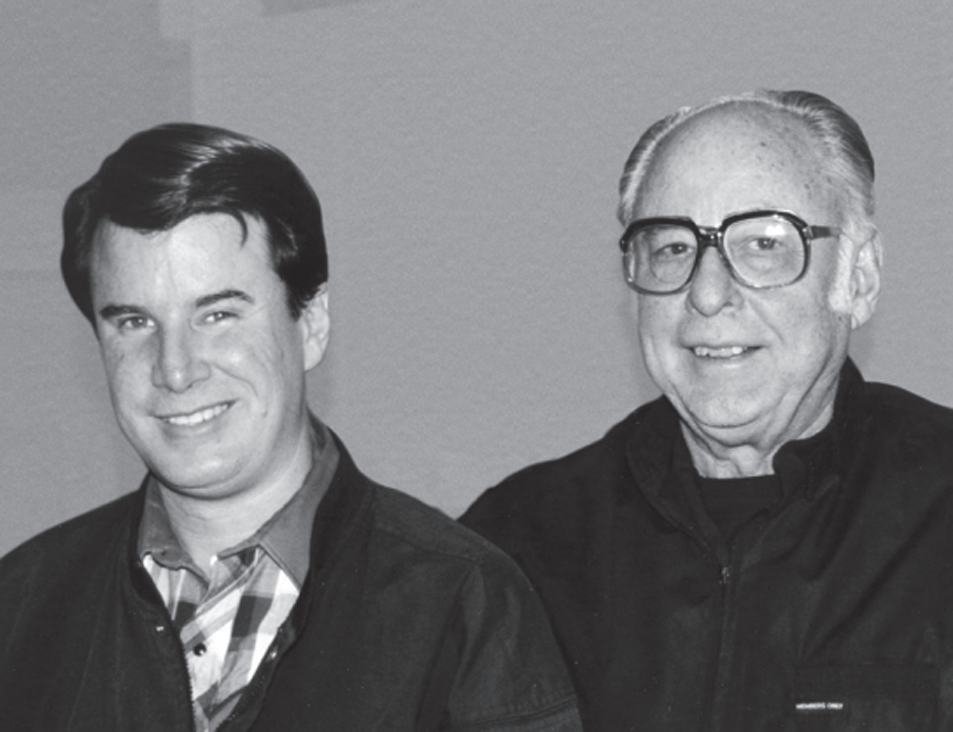

"As a parent of a person with a disability, I've supported my son through obstacles and challenges...and I've watched him break down barriers and challenge stereotypes, thanks to the support and services of PathPoint, formerly Work Training Programs. To show our appreciation, our family has set up a Special Needs Trust that will take care of George first, for his lifetime, and then provide a charitable legacy to PathPoint. That is why I am a proud parent and a Founding Member of the PathPoint Legacy Society. I invite you—parents, families, and friends—to join me in ensuring the future for George and others after him by joining the PathPoint Legacy Society today."

– James A. McDonald, Founding Member of the PathPoint Legacy Society

Discuss Your Plans

To discuss your plans with a PathPoint representative, please contact Rebecca Bogdanovic, VP of Development & External Affairs, at 805.863.3353, or Legacy@PathPoint.org. PathPoint also has an experienced Planned Giving Consultant who can help us answer any questions you may have.

If you have made plans to leave a legacy gift to PathPoint, we would appreciate notification of your intention.

Always be sure to consult with your own attorney and financial advisors to help you determine the best legacy giving strategy for you and your family.

Legal Name: PathPoint (formerly Work Training Programs)

Address: 901 Olive Street, Santa Barbara, CA 93101

Federal Tax ID #: 95-2371668

Legacy Giving Options

There are a wide variety of ways to provide for a legacy gift to PathPoint in your estate plans, from the very simple to the more complex. Most can be accomplished without any cost to the donor, while a few, such as a charitable remainder trust and special needs trusts, do require that an attorney draw up the needed documents.

Simple, "Revocable" Gift

Make a Bequest

Include a bequest in your will or living trust stating that a certain dollar amount, a specific percentage, or the residue of your estate will go to PathPoint at your death. This can be accomplished in the writing of your initial will, the updating of a will already in effect, or by adding a "codicil" or amendment to your existing will.

Create a Special Needs Trust

Use your will or living trust to create a Special Needs Trust after you are gone that will provide financial support as needed for your "special needs" family member, with a provision that after your family member's death, any residue not expended on their care will be a charitable distribution to PathPoint. (Be sure to use an experienced attorney to set up such a trust correctly.)

Designate PathPoint as a beneficiary of your IRA, retirement pension or annuity

All of these assets are considered "tax heavy", in that they will be subject to significant taxation (both income and estate taxes) if you leave them to your heirs. In contrast, the full value of the asset can be transferred tax-free to a qualifying charity like PathPoint. It is easy to name PathPoint as a full or partial beneficiary on the beneficiary forms provided to you by the custodian of your assets.

Name PathPoint As The Beneficiary Of An Existing Insurance Policy

Name PathPoint as the beneficiary of an existing insurance policy you no longer need or buy a new policy that names PathPoint as beneficiary. To learn more about how to leverage a smaller annual gift for premiums into a very significant legacy gift, please go to Legacy Life Insurance.attorney to set up such a trust correctly.)

Benefits of revocable legacy gifts are:

1) no money out of pocket,

2) changes can be made at any time by the donor, &

3) recognition now as a member of the PathPoint Legacy Society.

Irrevocable gifts like Charitable Gift Annuities and Charitable Remainder Trusts

require that your gift of cash, stock or real property be made now in exchange for life-time income for you and your spouse, or another designated family member. Other benefits, in addition to a life-time income stream, may include:

1) Current income tax deduction

2) Avoidance of long-term capital gains tax on appreciated stock or real property

3) Increase in your income and effective rate of return from rental property

4) Reduction in estate taxes by removing assets from your estate

5) Recognition in the PathPoint Legacy Society

6) Ability to leave a significant charitable legacy to your community

Charitable Gift Annuities

can be accomplished only through naming PathPoint as an additional beneficiary in an annuity done with a minimum of 40% going to the Santa Barbara Foundation using a simple two-page contract with the Foundation. No attorney is required. However, Charitable Remainder Trusts (and Lead Trusts) can name PathPoint as 100% beneficiary but do require services of your attorney and other advisors.

IRA Rollover

You can make a current gift now to PathPoint directly from your IRA, without paying income tax on the withdrawal.

Gifts of Stock and Real Estate.

Outright gifts of securities and real estate can be made to PathPoint, avoiding capital gains tax on the sale of appreciated stock or property. There is also a gift called a Life Estate (or Retained Life Estate) that enables the donor to gift title in their home to a charity like PathPoint while continuing to live in the house, with an agreement to continue to pay all of the taxes and maintenance costs during your lifetime. This affords a charitable income tax deduction that can be taken at the time title is transferred to charity. And recognition is accorded now for a gift in an amount equal to the appraised value of your home. Contact us for more information, or talk to your own legal and financial advisors.

Legacy gifts like those mentioned above are often called "planned giving" because they require careful financial planning for yourself and your family. Be sure to consult with your attorney, tax accountant or financial advisor before deciding on the best gift strategy for your individual and family circumstances.